Recent Middle East tensions are a reminder that geopolitical risk can flare up suddenly. And the headlines can be scary. But emotional, knee-jerk reactions aren’t the answer. Don’t overreact to geopolitical headlines.

See, geopolitical events are always a surprise. They’re inherently unknowable, so they’re never priced into the market.

That’s why stocks initially sell off on nasty geopolitical news. And it’s easy to overreact in the heat of the moment.

Emotional overreactions are a mistake. MAPsignals has your back with our unemotional, data-driven, geopolitical playbook.

Today, we’ll show you how to play the latest Middle East tensions and why our Big Money Index (BMI) agrees. Then we’ll identify the four sectors seeing the most Big Money buying in this volatile tape.

We know it’s easy to get faked out by geopolitical curveballs. That’s why we created an unemotional, data-driven geopolitical playbook you can use anytime bullets fly.

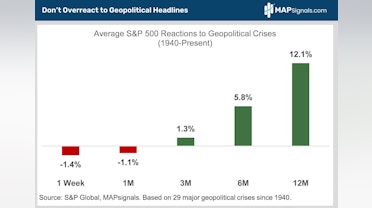

We analyzed 29 geopolitical events since 1940, ranging from wars to terrorist attacks to coups to pandemics. Here’s the upshot: timeframes matter!

What stocks do immediately after a geopolitical event doesn’t always tell you where they’ll be once the dust settles.

The S&P 500 has averaged 1.4% and 1.1% drops, respectively, a week and a month after geopolitical events. After Iran bombed Israel on April 13, the following week the index was down 3.1%.

But check out how it doesn’t pay to overreact. On average, the S&P 500 gains 1.3% three months after geopolitical events. Even better, the index chalks up 5.8% and 12.1% gains after six and 12 months, respectively, both of which are way above average:

The data shows how stocks tend to bounce back quickly. Now let’s dig deeper.

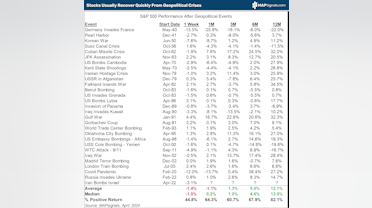

The table below details how the S&P 500 has reacted to every major geopolitical event since 1940.

It’s a great cheat sheet you can reference anytime geopolitical volatility strikes.

History’s verdict is crystal clear: geopolitical uncertainty consistently drives short-term market volatility, but stocks almost always bounce back quickly.

When bullets fly, don’t run for the hills. Instead, start prepping your buy list!

Are we getting the same market message from

the BMI?

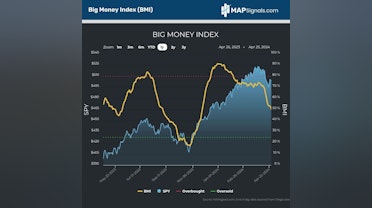

It has been a fantastic timing tool. Subscribers know we’ve been nailing market pivot points with it for years.

The BMI tracks institutional money flows. Readings under 25% are rare, indicating stocks are oversold and it’s time to buy. Conversely, readings over 80% mean stocks are overbought and traders should lighten up.

Let’s check out how helpful the BMI’s been since this bull market began in the fall of 2022.

Then it nailed the peak last July as it went to an overbought 84% and indicated

a pullback was ahead.

Let’s face it, the BMI has an amazing batting average!

Here’s the latest: the BMI has swooned from 75% to 50%. A decline this steep, this fast is really rare. When the bottom falls out, it means buyers are on strike and sellers are taking over.

But don’t run for the hills. Instead, start prepping your buy list. Capitulation is likely around the corner.

Remember, we’re looking for contrarian buy signals from the BMI when it drops to 25%. That’ll be the green light that stocks are ready to bounce.

Trying times are buying times!

The key takeaway from both our geopolitical playbook and the BMI’s recent drop is to expect short-term volatility.

But don’t panic. This is likely a buying opportunity ahead of a big rebound.

If all you do is buy extreme weakness in the S&P 500 index, you’ll do well.

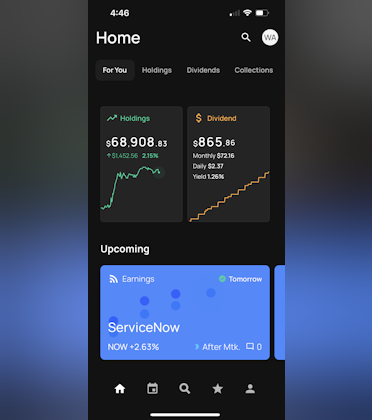

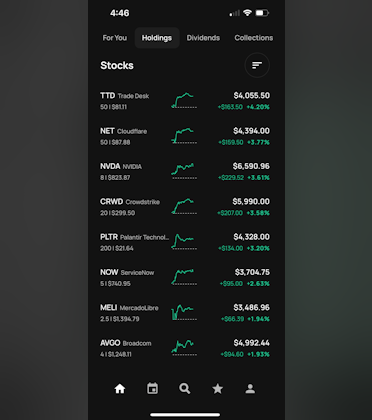

To do even better, focus on sectors seeing the most Big Money buying.

Market broadening is kicking into high gear as a strong economy and rising interest rates fuel a rotation out of technology and into cheaper, more cyclical sectors. Think energy, industrials, financials, and materials. It’s a safe bet these cyclicals will play a much bigger role in driving this bull market’s next leg higher. Check out our latest sector rankings to see how cyclicals have risen:

We know it’s easy to get faked out by geopolitical curveballs. That’s why we created an unemotional, data-driven geopolitical playbook you can use anytime bullets fly.

Since 1940, the S&P 500 has averaged 1.4% and 1.1% drops, respectively, a week and a month after major geopolitical events.

But don’t overreact to geopolitical headlines. Stocks tend to bounce back quickly.

On average, the S&P 500 gains 1.3% three months after geopolitical events. Even better, the index chalks up 5.8% and 12.1% gains after six and 12 months, respectively,

History’s message is clear. Geopolitical volatility is a buying opportunity.

The BMI agrees. It has collapsed at a rate rarely seen in the last 10 years. Whenever we’ve observed similar action, the next couple of weeks were volatile, with stocks in the red.

Don’t fret. A monster rally usually follows three months later. Prepare to buy the dip…and ride the rip.

If you want to find specific energy, industrials, materials, and financials stocks ramping with Big Money support, get started with a

MAPsignals PRO subscription. It’ll get you access to our

portal that updates every morning, showcasing the exact tickers getting bought and their scores.

As we’ve highlighted previously, brand new stocks are leading the next leg higher.

There are plenty of winning cyclical stocks to buy on weakness as the market broadens out. If you’re a Registered Investment Advisor (RIA) or a serious investor,

use a MAP to find them!

Invest well,

-Alec Young