Plenty of growth stocks are feeling the pain.

That’s what happens when institutional demand grinds to a halt.

Don’t fret. One rare setup just fired, indicating a major ultra-bullish signal is approaching.

The rips and dips keep coming for equities. The Fed presser from yesterday offered little confidence for investors. We’ll let other research shops recap that narrative.

At MAPsignals, we’re going to focus on what we do best: Money Flows.

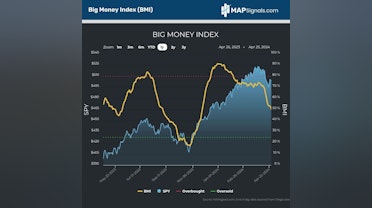

Our market North Star, the Big Money Index (BMI), has been in free-fall for weeks…even dropping further after yesterday’s intraday pump and slump.

But there’s good news. A monster bullish setup is forming in our data. If history is any guide, we are looking at a crowd-stunning rally coming later this year.

Now is not the time to get fearful. It’s time to get cheerful.

The all-clear signal is not here yet.

That’s evidenced by the Big Money Index sinking day after day.

Given Tech’s huge market weight in the S&P 500, those outflows are why major large-cap indices are anchored.

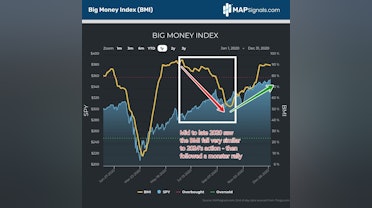

Below shows how the BMI continues to spiral, last hitting a YTD low of 47.2%:

Our BMI has been trending lower since December 29th. That’s a long period… one that suggests a major ultra-bullish signal is approaching.

Last week we took a deep dive in our data and found something interesting. When the BMI falls 40+ points in 16 weeks, it’s extraordinary.

In fact, over the past 30 years, it’s occurred 303 times.

While that may not seem exceptional on the surface, in reality most of those instances cluster around 17 discrete episodes throughout the 3 decade period including back-tested data.

But history proves these prolonged money flow dips are quite bullish over the medium to long-term. Even more striking are periods that are very similar to today’s environment.

I’m referring to conditions when the BMI fell 40+ points from a red-hot overbought reading over the next 4-month trading period.

Let’s visualize one from recent memory.

We experienced a similar peak to drop like now after the pandemic. From mid to late 2020, the BMI dropped from the 90 area to the low 50s, eerily similar to today.

By far this is the closest analog to today’s situation:

- Investors were still spooked by the unprecedented macro environment

- Bearish rhetoric was all over the media given the unfolding pandemic

That pullback eventually ended with a powerful rally starting soon later:

What’s important to note is that market lows were eventually hit and the BMI began rallying well ahead of the surge that followed.

Turns out, this similar pattern has been rather predictable in our data.

If you’re allergic to an extremely bullish setup, LOOK AWAY NOW.

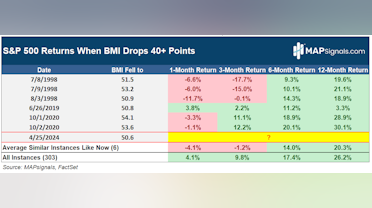

When we single out similar BMI pullbacks to now, we find 6 instances ranging from 1998, 2019, & 2020.

What we find is near-term stocks struggle with the S&P 500 falling 4.1% a month later and 1.2% 3-months later.

But the underlying message that you need to heed is stocks zoom 6 and 12 months later with average gains of 14% and 20.3% respectively.

If that doesn’t impress you, I’ve included all 303 instances as well. In aggregate, they forecast market beating forward returns:

But I don’t want to stop with the coming bullish message.

For those that think Technology stocks are not going to shine again…keep dreaming.

This massive BMI drop favors those bold enough to bet on high-quality growth stocks.

Here I’ve performed the same analysis but with the NASDAQ 100 (

$NDX). The same weakness is seen 1 to 3 months out, with -2.5% and -.2% returns respectively.

But that’s when you want to be accumulating best of breed stocks. 6-months later the

$NDX surges 31.6% and 12-months later an awe-inspiring 49.5% jolt is seen.

And for those curious, the 303 instances offer outstanding forward gains too:

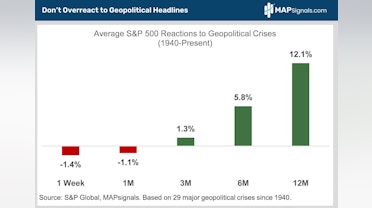

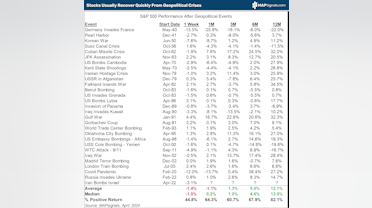

Folks, stop worrying about interest rates. You might risk missing a major ultra-bullish situation.

Instead, follow evidence-based data.

New market leaders are under heavy accumulation…now isn’t the time to bounce, it’s the time to pounce.

We are getting our subscribers ready for when the all-clear signal finally strikes. I firmly believe it’s around the corner.

A market map is the way.

Here’s the bottom line: Investors are looking for clarity in this turbulent market. Data has more answers than the news ever will.

We are currently witnessing a rare 40+ point drop in the Big Money Index (BMI). History says a little more pain will lead to monster gains in the coming months.

Not only that, whenever the BMI drops 40+ points from a red-hot overbought period similar to now, stocks have never been lower a year later, with the NASDAQ averaging a 49.5% twelve-month gain.

Don’t stop and stare. PREPARE!

After doing this study, earlier this week we sent

3 stocks to our PRO Members that we love for this coming uptrend. And chances are they aren’t names you’re familiar with…but the Big Money loves them!

Listen, a major ultra-bullish signal is approaching.

Don’t wait for the media bull whistle to blow…it’ll be too late.

Follow the money and you’ll be ahead of the move.

Have a great week!

If you’re a money manager, investment advisor, or someone that is serious about investing, now is a wonderful time to get started with a

MAPsignals PRO subscription.

Good things are coming!